Personal Loan Eligibility Criteria:

Salaried Professionals

Indian National

Minimum and Maximum Period for Repayment: 90 days

Minimum Monthly Salary INR 20,000

Above 21 years of age

Salary received through direct bank transfers only

Steady source of income on a monthly basis

Features of Creditt+:

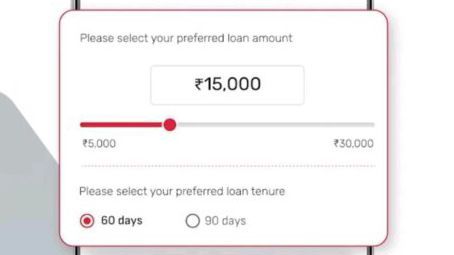

Personal Loan Available from INR 10,000 to INR 35,000

100% online loan application.

Fast Loan Approval.

Flexible Interest Rates and Tenures.

Transparency and Security.

Quick Disbursal.

No collateral needed.

Fully automated process.

No foreclosure charges.

Instant credit line.

Loan instantly credited to bank account once approved and accepted.

Multiple options to repay the loan.

Proprietary eligibility check.

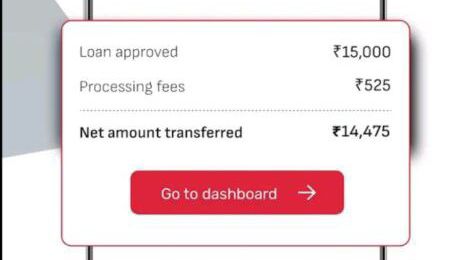

Low Processing Fees.

Loan Sanctioned in less than 15 minutes.

Zero membership or upfront fees.

No credit history of user is required.

Zero prepayment charges.

One Shot Repayment.

Multiple Languages.

•Maximum Annual Percentage Rate (APR): 73% based on the risk profile of the customer.

Personal Loan Repayment Calculation:

Loan amount: ₹10,000.

Interest Rate: 20% per year

Minimum and Maximum Period for Repayment: 120 days

Processing Fees: ₹350 (inclusive of GST) or 3% whichever is higher

In-hand Loan Amount: ₹10,000 (loan approved) – ₹350 (processing charge) = ₹9,650

Total Personal Loan Interest: ₹164 (₹10,000 x 20%/365 x 30)

Total Loan Repayment: ₹10164

Loan Processing fees will be subtracted upfront from the principal amount and the remaining balance is transferred over instantly in the user’s bank.

Documents required to complete the loan application process:

Aadhaar Card

Pan Card

Selfie

At least 3-month bank statements showing salary credits

USE MY REFERRAL CODE:- L66BZML