PayRupik is an online instant personal loan platform trusted by over 5 million users, provides you instant credit in minutes.

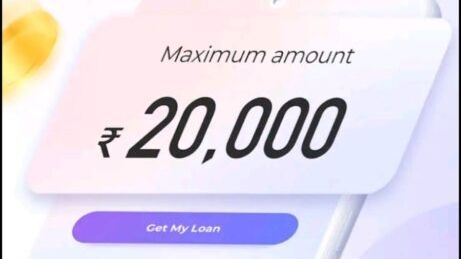

It is a loan product of Sayyam Investments Pvt Ltd which is a registered NBFC under RBI. You can avail loan amount ranging up to ₹20,000, process is fast, easy and safe.

If you are looking for a friend who can easily borrow money without making excuses, PayRupik is your best friend.

Production:

Loan Amount: from ₹1000 to ₹20000

Minimum Loan Tenure: 91 days

Maximum Loan Tenure: 365 days

Maximum Annual Percentage Rate (APR): 35% per annum

Processing Fee: from ₹80 to ₹2000 depend on the loan tenure and amount

GST: 18% on the processing fee in accordance with the law and policy of India

The representative example:

For the loan amount is ₹6000 and the interest rate is 25% per annum and the tenure is 120 days, then the interest payable is calculated as follows:

Interest = ₹6000 x 25% / 365 x 120 = ₹493

Processing Fee = ₹100

GST = ₹100 x 18% = ₹18

The total repayment amount in 120 days shall be ₹6000 + ₹493 + ₹100 + ₹18 = ₹6611

APR = (₹6611 – ₹6000) / ₹6000 / 120 x 365 = 30.97%

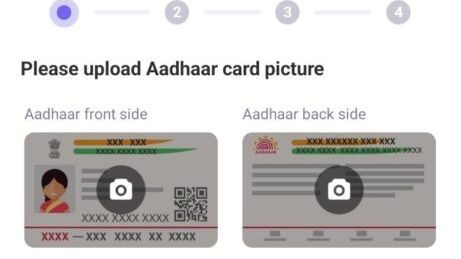

Eligibility:

You must be an Indian national.

You must be over the age of 18.

You must have a steady source of income on a monthly basis.

Minimal household income eligibility:

Annual household income is above Rs. 3,00,000/- (Three lacs) by all sources and means.

The term ‘household’ shall mean an individual family unit, i.e. husband, wife and their unmarried children who are above the age of 18 years.